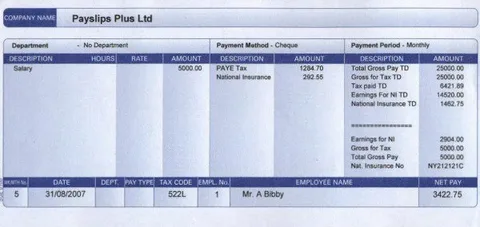

A payslip is a document that is issued to an employee at the end of each pay period. It shows the employee’s gross pay, any deductions that have been made, and the net pay that the employee will receive in United Kingdom. The payslip will also show any leave that the employee has taken during the pay period, as well as any allowances that the employee is entitled to.

Payslips in UK are usually issued by employers every month, and you can expect to receive one when you have completed your full working week. This is the time that your employer will pay you your wages for the previous pay period. If you work more than one week in a pay period, you will be paid your wages for each week on a payslip. Your payslips may be issued weekly, fortnightly or monthly depending on the type of employment that you have. The payslips that you receive from your employer will vary in size.

what is a p60

A P60 is a document that your employer must give you at the end of the tax year. It shows how much money you have earned and how much tax you have paid. If you are an employee, you will need a P60 to help you complete your Self Assessment tax return. P60 – Parent’s Tax Return If you are an employee, you will need to complete your Self Assessment tax return in United kingdom. Your P60 will show how much tax you have paid and how much you have earned.

UK P60 is a document that your employer must give you at the end of the tax year. It shows how much money you have earned and how much tax you have paid. If you are an employee, you will need to complete your Self Assessment tax return. Your P60 will show how much tax you have paid and how much you have earned. The P60 is a document that your employer must give you at the end of the tax year. It shows how much money you have earned and how much tax you have paid.

pmp payslips

As an employee, you are entitled to receive a pmp payslips in UK each time you are paid. Your pay slip is a record of your earnings and deductions for a given pay period. The pay slip will show your gross pay, any deductions that have been made, and your net pay. Your pmp payslips will show your gross pay, any deductions that have been made, and your net pay. Your pay slip will show your gross pay, any deductions that have been made, and your net pay.

If you have any questions about your payslip, be sure to ask your employer. They are required to provide you with this information. If you believe that there are errors on your pay slip, you should also bring this to your employer’s attention.

online payslip

Most employers in the United Kingdom now offer their employees the option to view and print their payslips online. This is a convenient way to keep track of your earnings and ensure that you are being paid the correct amount. To access your online payslip, you will need to log in to your employer’s online portal. Once you have done this, you will be able to view and print your payslip for the current or previous pay period. If you have any questions about your payslip, you should contact your employer directly.

Employers in the UK must provide an annual statement of account for their employees. The statement of account must show the amount of the employee’s salary, pension contributions, and any other amounts which are payable to the employee under a scheme. The annual statement of account must be provided within 28 days of the end of the financial year (31 December). The annual statement of account is provided electronically in a pdf format. Employees can view their annual statement of account online. You will need to log in to your employer’s online portal to view and print your statement of account.

how to get p60

There are a few steps you need to take in order to obtain a p60 in the UK. First, you need to have been employed for at least a year by the same company. Second, you need to request the document from your To request a tax document from your employer, you will need to complete a Form P45. You will need to provide your full name, date of birth, address, and employer. You will also need to provide your National Insurance number and the date you were employed. employer. Finally, you need to fill out a form and submit it to the HMRC.

You can find the form here. Once you have completed this process, you should receive your p60 within three months. This is the most common type of document. It is a proof of employment that you can use when applying for jobs or starting a new job. If you have a P45 but no P60, you may still be able to use it. In this case, you will need to complete a P45/5 and send it to the HMRC.