How does health insurance art work take into account you have got were given a $100,000 coronary coronary heart surgical treatment it’s a included medical price beneathneath your health insurance plan and let’s anticipate this health insurance plan has a $1,000 annual deductible 20% coinsurance after deductible a $2,000 out-of-pocket limit and a 2 million dollar annual limit in your health insurance coverage in this video we are going to provide an reason behind how the ones specific additives of a health insurance insurance art work in advance than we begin it’s miles important to look at that any health insurance insurance sold after September twenty 1/3 2010 will now now no longer have a life-time maximum limit on most of the plan blessings and any health insurance insurance sold after January 1st 2014.

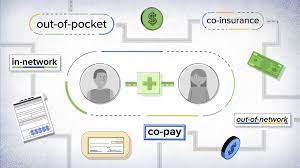

will now now no longer have an annual limit on most plan blessings the number one factor we are going to talk about in this video is a deductible what’s a deductible normally a deductible is the amount of coins you need to pay every 12 months in advance than your health insurance plan starts offevolved offevolved to pay for included medical expenses so with a $100,000 coronary coronary heart surgical treatment bill you are answerable for paying the number one $1,000 after this $1,000 deductible is met the insurance organization can pay a percentage of the bill and you could pay the coinsurance.

let’s talk about coinsurance what is coinsurance normally coinsurance is a cost-sharing requirement in which you are answerable for paying a fine percentage and the insurance organization can pay the last percentage of the included medical expenses after your deductible is met for a health insurance plan with 20% coinsurance as quickly because the deductible is met the insurance organization can pay 80% of the included expenses on the equal time as you pay the last 20% until your out-of-pocket limit is reached for the 12 months .

what is an out-of-pocket limit normally the out-of-pocket limit is a maximum quantity you may pay out of your very very own pocket for included medical expenses in a given 12 months for a plan with a $2,000 out-of-pocket limit you may pay a 1000 dollar deductible and 1000 dollar coinsurance on the equal time because the insurance organization covers the last ninety eight thousand greenbacks of the coronary coronary heart surgical treatment bill even if you’re hospitalized yet again withinside the same 12 months the insurance organization can pay 100% of your included expenses until you reap your annual coverage limit

what is an annual coverage limit some health insurance plans location dollar limits upon the claims an insurance organization can pay over the course of a plan 12 months so if to procure an insurance insurance with an effective date of July 2011 your plan 12 months would possibly run from July 2011 until June 2012 if you have an annual coverage limit of million greenbacks and you have got were given medical bills that cost greater than million greenbacks for the duration of your plan 12 months you may be answerable for paying those bills from your very very own pocket as quickly as your new plan 12 months begins offevolved offevolved in July 2012.

your deductible coinsurance out-of-pocket limit and annual coverage limits would possibly all reset and the insurance organization would possibly as quickly as yet again begin to pay your included claims beginning September twenty 1/3 2010 the Patient Protection and Affordable Care Act health care reform begins offevolved offevolved to section out annual dollar limits starting on September twenty 1/3 2012 annual limits on health insurance plans need to be as a minimum 1,000,000 greenbacks thru

2014 no new health insurance plan is probably accepted to have an annual dollar limit on most included blessings some health insurance plans sold in advance than March twenty 1/3 2010 have what is called grandfathered fame health insurance plans with grandfathered fame are exempt from severa

modifications required thru health care consisting of this section-out of annual limits on health coverage right here is one greater concept you need to be familiar with some health insurance plans provide co-payments what is a co-charge normally a co-charge or copay is a selected flat charge you pay for every medical provider such as $30 for an place of job visit after the $30 copay the insurance organization can pay a the relaxation of the included medical expenses.

occasionally hassle to the deductible and coinsurance fine recommended preventive services immunizations and screenings are included and now no longer the usage of a cost-sharing or co-payments on health insurance plans sold after March twenty 1/3 2010 let’s anticipate you’re now now no longer feeling well and went to see your physician.

who expenses $ hundred for the place of job visit in case your insurance plan has an place of job visit copay ‘men of $30 then you may first-class be answerable for the $30 and the insurance organization will cover the last one hundred and seventy greenbacks but if you purchase your health insurance insurance after March twenty 1/3 2010 and you’re due for a regular preventive care screening like a mammogram or colonoscopy you may be able to get maintain of that screening

without growing a co-charge you may talk in your insurer or your licensed a health insurance agent if you need assist identifying whether or not or now no longer or now now no longer you qualify for screening without a copay there are five important modifications that befell with individual and very own own family health

insurance guidelines on September twenty 1/3 2010 those modifications are brought protection from fee will boom insurance agencies will need to publicly disclose any fee will boom and provide justification in advance than raising your monthly rates brought protection from having insurance cancelled an insurance organization can’t cancel your insurance except in times of

intentional misrepresentations or fraud coverage for preventive care fine recommended preventive services immunizations and screenings is probably included and now no longer the usage of a cost-sharing requirement no lifetime maximums on health coverage no lifetime limits on the dollar cost of those health blessings deemed to be important thru the Department of Health and Human Services no pre-modern-day scenario exclusions for children if you have children beneathneath the age of 19 with pre-modern-day medical conditions their

application for health insurance can’t be declined due to a pre-modern-day medical scenario in some states a toddler can also need to appearance beforehand to the state’s open enrollment length in advance than their application can be legal if you have questions which have been now now no longer included thru this video please contact a certified be health insurance agent at one eight hundred nine seven seven eight eight six zero