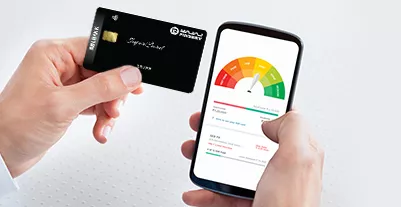

It may just take a few clicks or taps of a button to receive your bajaj finserv CIBIL score or from a bureau like Experian or CIBIL, but what occurs afterwards can be complicated and tricky for some people. Too many folks don’t understand what comes after an HDFC CIBIL score check or what details a credit report does or does not include. However, it is important to keep in mind that your credit report has a big impact on your life, from the house you can purchase to the car you drive. Here we’ll dispel some of the most widespread misconceptions regarding credit reports in this article.

Your loan application’s outcome is determined by a credit bureau: Many people have the notion that since credit bureaus create your credit report, they also decide whether you’ll be approved for a loan or credit card. Nothing is more incorrect than this statement. Only the credit information that lenders need to process your application, such as a quick HDFC CIBIL score check, amongst other things, is provided by credit bureaus. Lenders make decisions about your application based on information they have about you and information they receive from credit bureaus.

If you have a good credit history, you have never borrowed anything in the past: Many people tend to believe that if you have no credit history, lenders will still consider you loan-worthy. That is incorrect. In fact, having some borrowing history reflected on the bajaj finserv CIBIL score is beneficial since it makes it simpler for lenders to determine your risk level based on your repayment history. Without this information, a lender finds it challenging to assess your creditworthiness and may even decide to reject your loan application. Hence, the HDFC CIBIL score check will tell you in advance whether you are eligible for the loan.

Regularly checking your credit record will lower your credit score: Many people also have a propensity to believe that by regularly reviewing their credit report, they risk lowering their credit score. This is again some false fact. Checking your credit report many times usually just results in a soft inquiry, which does not affect your credit score negatively. In fact, you should definitely periodically review your credit report to look for any mistakes or inaccuracies that might affect your credit profile. Thoroughly reviewing your credit report will also assist you in reducing the likelihood of fraudulent activities like identity theft.

After you are married, you and your spouse will share a credit report: Even if you open a joint account with your spouse after you get married, your credit history of bajaj finserv CIBIL score will still be independent and will not be combined with theirs. In actuality, both of your credit reports will show information about your joint or co-signed accounts and your individual accounts.

When you close an account, your credit report will no longer include the same: The idea that a closed account won’t appear on your credit record is among the most widespread false claims. This is untrue because it all depends on the circumstances surrounding the account closure. It’s possible that the account will remain on your credit report until the credit reporting time limit, even if it was paid in full or written off. According to the bureau’s guidelines for reporting, if the closed account was in good standing when it was closed, it will still appear on your credit report.

You can hold off checking your credit report until you apply for credit: Checking your credit report and bajaj finserv CIBIL score is one of the most important actions to take before applying for a credit card, personal loan, or, in fact, before making any significant financial decision. The benefit of actively reviewing your credit report allows you to see any inaccuracies or indications of fraud before you apply for a loan. This way, you can address any errors with the credit bureau and lower your risk of having your loan application denied as a result. You should actually make a practice of checking your credit report and bajaj finserv CIBIL score at least once a month to evaluate how your finances are doing. Don’t worry; constantly pulling your credit report won’t affect your score.

All credit bureaus have the same information about borrowers: Your credit report is a storehouse of information that contains a detailed history of your credit profile and any personal loans or credit cards that have been associated with your name. When you apply for a loan or credit card with a bank, the lender pulls your credit report from a credit agency and uses it to hdfc cibil score check your credit profile. This credit bureau can be one of many, including Experian, CIBIL, Equifax, and others. Although your credit report is fundamentally the same across all of these bureaus, there may be slight variations due to variations in their accounting and reporting rules. These variations, meanwhile, should not be mistaken for mistakes on credit reports.

My income has an impact on my credit rating: Your income is NOT listed anywhere in your credit report, which is the basis on which your credit score is created. Therefore, if your credit behaviour is poor, you may have a CTC of Rs. 15 lakh; after hdfc cibil score check, you still could have a low credit score. Similarly, a person with a relatively low income may have a good credit score if their credit history is strong, which includes, among other things, regular bill payments and a balanced credit use ratio.

In order to prevent credit report inaccuracies, it is crucial that you regularly monitor your credit report. Even a seemingly minor spelling error might have serious consequences. Another issue that affects credit reports frequently is instances of fraud or identity theft. After reading this article carefully, it’s time to stop believing the myths about credit reports and start checking them more frequently because, trust us, it will only help you in the future.

Read also about : Well Know Scrap Buyer in UAE 2022