Cryptocurrency mining has gained immense popularity as a way to earn digital currencies like Bitcoin and Ethereum. To get started with mining, you need a powerful crypto mining machine. This article aims to provide beginners with essential tips to Buy crypto Mining machine.

1. Understand Cryptocurrency Mining

Before diving into purchasing a mining machine, it’s crucial to understand the basics of cryptocurrency mining. Mining involves solving complex mathematical problems that validate transactions on a blockchain network. Miners are rewarded with newly minted coins for their efforts. Different cryptocurrencies use various algorithms, so research the coin you want to mine and its associated algorithm.

2. Research Mining Hardware

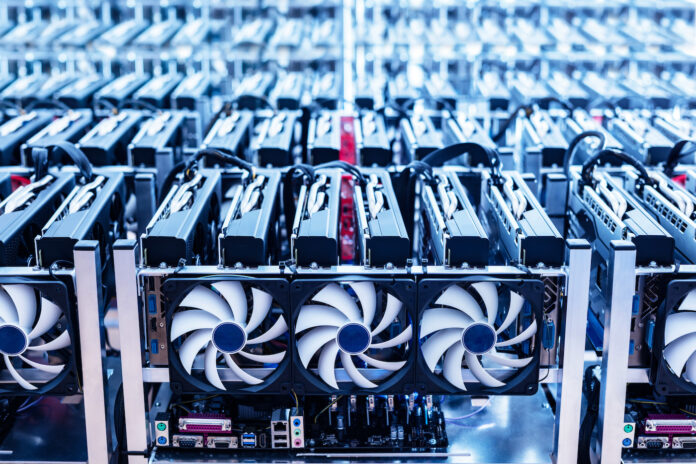

Mining hardware comes in various forms, such as ASICs (Application-Specific Integrated Circuits) and GPUs (Graphics Processing Units). ASICs are specialized machines designed for specific algorithms, offering high efficiency but limited flexibility. GPUs, on the other hand, are more versatile and suitable for mining multiple cryptocurrencies.

3. Consider Hashrate

Hashrate refers to the computational power of a mining machine. A higher hashrate means more calculations can be performed, increasing the likelihood of mining rewards. Look for a machine with a balance between hashrate, energy consumption, and cost. Keep in mind that higher hashrates often come with higher costs and power requirements.

4. Energy Efficiency

Mining can be energy-intensive, leading to high electricity bills. Opt for energy-efficient mining machines to maximize your profitability. Research the power consumption of the hardware and calculate potential energy costs against potential earnings.

5. Cooling and Noise

Mining machines generate heat, so adequate cooling is essential to prevent overheating and ensure optimal performance. Some mining machines come with built-in cooling solutions, while others may require external cooling systems. Additionally, consider noise levels, especially if you plan to set up the machine at home.

6. Budget Considerations

Mining hardware can vary greatly in price. Set a budget based on your financial capabilities and expected mining returns. While it might be tempting to go for the most expensive machine, remember that profitability also depends on factors like electricity costs, coin value, and network difficulty.

7. Check Reviews and Reputation

Before making a purchase, read reviews from reputable sources and user feedback. Look for established manufacturers with a positive reputation in the crypto mining community. Avoid unverified sellers or deals that seem too good to be true, as they might be scams.

8. Future-Proofing

Cryptocurrency mining is an evolving field. Consider the potential longevity of the hardware you’re purchasing. Will it still be profitable in the future as network difficulty increases? Research upcoming changes in algorithms or consensus mechanisms that might affect your chosen coin’s mining process.

9. Consider Joining a Mining Pool

Mining individually might not yield consistent results, especially for beginners. Joining a mining pool allows you to combine computational power with other miners, increasing the chances of earning regular rewards. Research reputable mining pools with fair reward distribution systems.

10. Stay Informed

The cryptocurrency landscape is dynamic, with new coins, algorithms, and hardware constantly emerging. Stay informed about industry trends, hardware releases, and changes in mining algorithms. This knowledge will help you make informed decisions and adapt to the evolving mining environment.

Conclusion

Buying a crypto mining machine requires careful consideration of factors like hashrate, energy efficiency, cooling, budget, and future-proofing. By understanding these aspects and conducting thorough research, beginners can make informed decisions that align with their mining goals and financial capabilities. Remember that while mining can be profitable, it’s essential to be realistic about potential risks and rewards.