In this article, we will explore the top tax brackets for married filing jointly. The tax brackets are divided into four categories: 10 percent, 15 percent, 25 percent and 28 percent. We will then outline how these numbers determine how much you pay in taxes on your income. tax brackets married filing jointly

What is a tax bracket?

There are six tax brackets for married taxpayers filing jointly: 10%, 12%, 22%, 24%, 28%, 31%. The effective federal income tax rate for a married couple in the 10% bracket is $10,000. The effective federal income tax rate for a married couple in the 12% bracket is $12,000. The effective federal income tax rate for a married couple in the 22% bracket is $22,000. The effective federal income tax rate for a married couple in the 24% bracket is $24,000. The effective federal income tax rate for a married couple in the 28% bracket is $28,000. The effective federal income tax rate for a married couple in the 31% bracket is $31,000. nationaltaxreports.com

What are the tax brackets for married filing jointly?

If you’re married and filing jointly, you’re in the 25% tax bracket. That means your taxable income is $75,000 or less. If your taxable income is more than $75,000, you’re in the 28% tax bracket. Your taxable income goes up by $5,000 for every $10,000 over $75,000. So if your taxable income is $100,000, you’re in the 31% tax bracket. And if your taxable income is over $110,000, you’re in the 33% tax bracket.

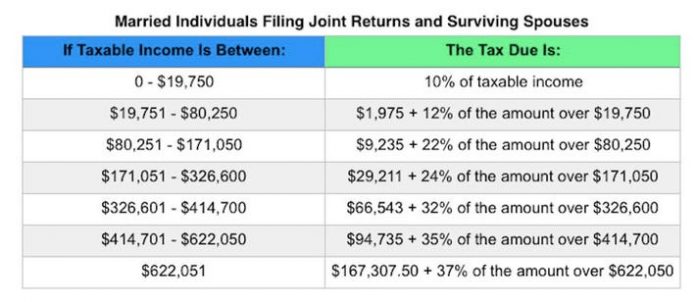

Here’s a helpful table that shows which tax brackets apply to specific incomes:

Income Tax Bracket Single Filing Jointly Married Filing Jointly First $0-$9,525 10% 15% Second $9,526-$37,650 12% 22% Third $37,651-$91,900 14% 24% Fourth $91,901-$191,650 16% 32% Fifth $191,651+ 17% 35%.

Discussion of tax brackets for single individuals

The 2017 tax brackets for married filing jointly are:

Taxable income: $183,000 to $207,500

Income above $207,500 is taxed at 37%.

Taxable income: $157,500 to $209,000

Income above $209,000 is taxed at 33%.

General Tax Deductions

The top tax brackets for married filing jointly are as follows:

In 2017, the tax bracket for married couples filing jointly is $207,500. This means that if your income falls within this range, you will be taxed at a rate of 33%. If your income falls within the next higher tax bracket – which is $250,000 for couples – your tax rate increases to 37%. However, if your income exceeds $207,500 and you are married filing jointly, your tax rate decreases to 25%.

Conclusion

As you probably know, income taxes are based on your income and marital status. Here is a look at the top tax brackets for married filing jointly as of 2019:

Married Filing Jointly (MFLY) Taxable Income Tax Rate $0-$19,050 10% $19,051-$77,400 12% $77,401-$157,500 22% $157,501-$315,000 24% over $315,000 32%