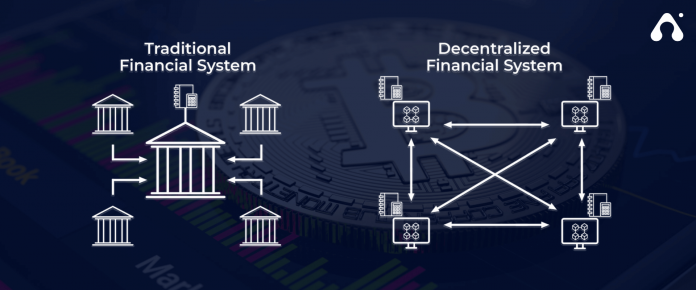

It’s been a major shift from traditional banking to a decentralized banking system. We’ll see more decentralized forms of banking in the future, but should you be worried? Not necessarily. The evolution of decentralized finance banking is where the future lies for many industries.

Decentralized finance banking is the application of a system where banks are distributed across multiple locations to reduce the “middleman” role and make transactions faster, simpler and cheaper for customers. This article will take you on a journey through history. Decentralized finance (DF) banking combines several technologies for secure and immediate business settlements over encrypted networks.

The next few years will be pivotal in the evolution of decentralized finance banking. There is a lot of hype and speculation surrounding Decentralized finance banking.

The history of decentralized finance is long, but it began with Bitcoin.

Decentralized finance history began with Bitcoin; the first cryptocurrency invented in 2009 by a pseudonymous developer called Satoshi Nakamoto. It was designed to be a peer-to-peer electronic cash system with no central authority or banks involved. Removing the need for intermediaries and their fees enabled users to spend money directly from one person to another without going through an exchange or bank.

Bitcoin’s use as an alternative currency grew rapidly, with people worldwide starting to use it to pay for everything from plane tickets to pizza. The value of each bitcoin has fluctuated wildly in recent years.

As Bitcoin grew in popularity and usage, more people became interested in using cryptocurrencies like Ethereum and Litecoin, as well as other types of decentralized networks that allow users to create their currencies and transact directly with each other without having to rely on an intermediary such as a bank or government agency.

Decentralized finance has been around for over a decade, but there’s still plenty we don’t know. We can say the evolution of decentralized finance banking began with bitcoin.

The Shift from The Traditional Banking System

Many financial institutions have been experimenting with the evolution of decentralized finance banking in recent years. These companies are not only using blockchain technology but also using other fintech initiatives such as artificial intelligence (AI) and machine learning (ML).

It can be more efficient, secure, and cheaper than traditional banking practices. For example, banks use expensive hardware and software to manage transactions and keep records of customers’ accounts. With decentralized finance banking, however, all these tasks can be handled by a computer program or blockchain network. Banks need not invest in costly infrastructure to maintain the same service they offer today.

Another benefit is that decentralized finance banking helps reduce customer and bank costs. Because a single entity does not control the technology, there are no middlemen who have an interest in inflating prices or charging fees on every transaction made through their platform. As a result, customers save money because they pay less for all their transactions once instead of paying them one by one over time. Banks also benefit from lower operational costs thanks to no need for human intervention in processing payments.

Decentralized finance banking is taking over the financial sector because it’s more efficient, cheaper, and less risky than centralized banking. Planning to shift to decentralized banking is an easy process with Defi development company.

Why Decentralized Finance Banking Is Taking Over

Decentralized finance banking is a new way of business that allows people to transfer money without using a bank. Instead, they use an app or software to send money through peer-to-peer networks. It means no intermediary, which makes it faster and less expensive than traditional methods.

The main difference between this type of banking and traditional methods is that money isn’t held in a central location. Instead, it’s spread among different people who have their currencies in their wallets or accounts. No person can control your money because you can access all the cash anytime. And because of all these reasons, decentralized finance banking is taking over.

The DeFi Boom

The decentralized finance (DeFi) movement has been growing rapidly since its inception in 2018. The industry’s explosive growth can be attributed to the growing demand for more flexible, secure, and transparent financial services.

Decentralized finance is a financial ecosystem that offers new opportunities and benefits to users, such as faster transaction speeds and lower fees.

DeFi, or decentralized finance, is a growing financial ecosystem that has been around for a while. But the de-centralization of finance is only now reaching critical mass. The first major milestone was in May 2019 when Maker launched its stablecoin Dai, which soon became the most popular DEX in the world.

In addition to Dai, dozens of decentralized exchanges are now available worldwide. These exchanges allow users to trade stablecoins like Dai and Tether against other cryptocurrencies or fiat currencies like USD (or even Bitcoin).

Decentralized finance has quickly become a highly popular alternative to traditional banking. Users enjoy lower fees, greater liquidity, and full control over their funds.

Why is DeFi Amassing So Much Interest?

Decentralized finance (DeFi) is a new financial product that does not require a third-party intermediary. The idea behind decentralized finance is to cut out the middleman and enable direct peer-to-peer payments with no central authority or single point of failure, which could result in massive consumer savings.

DeFi has been around for almost a decade but has only recently become mainstream. This is thanks to new technologies like Ethereum and blockchain, which power this new wave of innovation.

The emergence of DeFi has led to an explosion in interest from investors and consumers alike. In fact, according to a recent survey conducted by CoinDesk, DeFi accounted for almost half (46%) of all investment assets in Q1 2019. This has led many players in traditional finance to question whether they need to adapt their strategies or even change their entire business models.

The Future of DeFi Banking Looks Bright.

The future of DeFi banking looks bright. Blockchain technology can bring about a new wave of financial innovation and democratize access to finance for billions of people worldwide.

In some ways, we’re already seeing it in practice. Decentralized exchanges like 0x and Kyber Network have helped drive a small-scale revolution in the space by allowing users to trade tokens without having to deal with the bureaucracy of traditional exchanges.

But it does not just exchange that is seeing this shift — banks are starting to catch on too. Banks are moving so quickly that they’re already outstripping their peers in the fintech sector when offering services through blockchain technologies.

Conclusion

It may not be long until decentralized finance works its way into the mainstream. The past few years have seen a lot of progress in this field—perhaps more than many people realize. If the future is more inclusive and financially cut-throat, we should be bracing ourselves for changes. We live in an age of exponentially growing technology, including financial technology. Decentralized finance is one of the fastest growing sectors in the world today, and understanding of financial system is significant nowadays. And with the evolution of decentralized finance banking, banks will likely soon be obsolete.