Setting up a company in Malta has never been made easier. They invest in technology to streamline the process and lower the minimum capital requirement.

There are also agencies that help make the Malta company formation process even easier. While it’s easy to start a company in Malta, you still need to undergo a lot of processes. To help you focus on business operations, they will shoulder some of the burdens of setting up a company.

Remember that time is gold when it comes to running a business. These company formation agencies in Malta can save you hours of trouble. Not only that but some also offer other corporate services such as bookkeeping and recruitment.

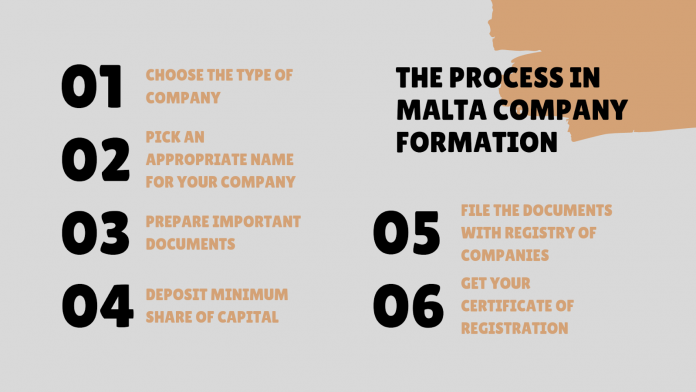

But to make the most out of their services, it helps to know the registration process. This section lists the steps for Malta company registration.

1- Choose the Type of Company You Plan on Starting

Malta has a lot of business vehicles available for people who want to start a company. The Maltese Company Law lets you establish a variety of business structures, such as:

- Limited liability company

- General proprietorship, which is the best option for small to medium companies

- Sole proprietorship, if you’re the only one who owns the company

- Joint stock corporations, if the company has at least two shareholders

- Holding and personal holding company

- Branch or subsidiary offices

2- Pick a Name for Your Business

Not only is the type of company you want to start important, but so is the name. A company’s name cannot be a duplicate of another company’s name. It should not also contain specific phrases that are insulting.

You should not choose a name that misleads people regarding the nature of your business. But in some situations, you should have evidence that you can use specific phrases as part of the company name. Some of these phrases include “Insurance,” “Blockchain,” or “Bank.”

In short, the company name should be a unique name that accurately reflects your company’s endeavor.

3- Prepare Important Registration Documents

Once you find the right company type, it’s time to gather all the documents needed. You need to draft a Memorandum and Articles of Association for a limited liability corporation. Aside from this, the Registry of Companies may need you to submit other documents.

Below are some of the important documents you need to prepare.

Memorandum of Association

A memorandum of association is necessary for the company formation in Malta. This corporate document regulates the company’s external affairs. Before submitting this document, make sure it includes the following:

- Whether the business is private or publicly traded

- The title and address of every subscriber

- The company’s name

- The Malta office where you register the company

- The company’s goals

- The minimum share capital and its division into shares of a fixed amount. Also include the number of shares each subscriber has purchased and the amount paid up for each share. If there are different class shares, state the rights attached to each class of shares.

- The number of directors the business has, their names and addresses. If any of them is a body corporate, also include the title and registration of the body corporate.

- The way the company will exercise a representation. Also include those vested by this representation

- The secretary’s name and address

- The duration of the company

- Official identification document number of each director, secretary, and shareholder

If you’re registering a public company, you need to attach a separate document to the memorandum. In this document, provide the following information:

- The total or estimated cost that the company is charged to as it was formed. Make sure to include up until the company is permitted to start. Also include the costs that come with the transactions made because of the permission.

- A description of any benefit given to anyone who participated in the company’s founding. State as well the events that led to this authorization before the company is allowed to start doing business.

Article of Association (AoA)

Every business is required to file an agreement known as the AoA or the by-laws of the company. This document outlines the company’s internal policies and procedures.

When drafting the AoA, you don’t need to follow any specific format or include certain details. You’re free to establish the rules that will regulate your operation. But be sure to draft it within the confines of the Companies Act and other applicable laws and regulations in Malta.

Form BO1

Form BO1 is a supplemental form that you submit together with the application. This document is not required for every business. You only need to submit one if any of the shareholders of the company are corporate bodies. In this case, you need to disclose the names of the ultimate beneficial owners of the company.

The Memorandum and AoA can be complicated and serve as the shareholders’ contract. Because of this, it’s best to call a lawyer to draft these two documents. This specifies the authority you grant to directors and any restrictions that apply.

4- Deposit the Required Minimum Share Capital

Any new limited liability business will require a certain amount of capital to cover different expenses. The Memorandum and AoA should include information about the capital sum invested. The amount should be more than €1,200, but you can deposit only 20% of it at the start.

Let the banker know what this money is for and when you may pay it into the account. This way, they will keep it separate until your company is officially registered. The bank will, then, provide you with a receipt, which is proof of your paid-up share capital.

5- File the Documents with Malta Business Registry

You can file the documents with the Malta business registry through online or physical means. They have clear instructions on how you can proceed with online registration on their official website. You should know that you have to pay fines for missing documents and late filing.

Aside from the documents listed above, here are other things you need to submit to the registry:

- Evidence of paid-up share capital – submit this in the form of a bank deposit at the time of incorporation.

- Proof of payment of registration fee – you can pay the registration fee upon delivery of other documents. The amount often depends on the authorized share of capital.

6- Get Your Certificate of Registration

After submitting the documents, the Registrar will give you a Certificate of Registration. This is proof of establishment and the country permits you to operate on the day you get the certificate.

The amount of time it takes for you to set up a company in Malta depends on different factors, including:

- The type of company you’re registering

- Submission of all the required paperwork

- Any pending information that you need to give to the Registrar

This usually lasts between five and ten days if everything is in order. With a company formation and registration agency, you can register your company within 2 days.

Final Thoughts

Setting up a company in Malta is the best choice you’ll make. The country boasts a lot of attractive features. Your business will enjoy taxation benefits, geographical advantages, and low incorporation costs. Most of all, it has one of the easiest registration processes in the EU region.

With that said, take some time to familiarize yourself with the process. This will help you prepare the right documents and avoid paying penalties. Better yet, have an expert to guide you throughout the whole process. Having an extra hand does a lot when it comes to company formation in Malta.