At one point or another, we have experienced financial difficulties, especially when we don’t have enough cash. Different emergencies like medical bills, things to buy, and other essential things in life could put us under financial strain.

Some people are lucky enough to have friends or families who could easily borrow the money they need. In contrast, others are not so lucky, making them seek financial help.

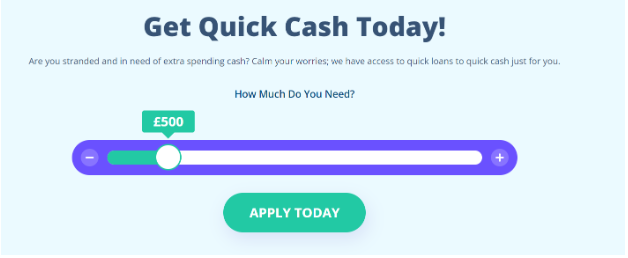

Currently, there are different loans available for people to choose from, one of which is the quick cash loan which has become prevalent. This loan is easy to get with the approval process being done without difficulty.

Getting the right lender can be a lender for a borrower; this is why they look out for loan agencies that can help them. Payday Loans UK happens to be the perfect solution for borrowers.

What makes Payday Loans UK unique is how they put clients first and connect them with lenders who don’t have outrageous interest rates and provide favorable terms to borrowers.

We are aware that because of the short time that instant cash lenders give borrowers to pay back loans, it may make them increase the interest rates. These interest rates often become too high and make borrowers pay back what they owe.

Payday Loans UK considers these when giving borrowers a list of lenders to pick from. They ensure that the process is easy for clients because they want to make the application process easy for clients.

Anywhere you are, provided you have access to the internet, you can start your application process when you go to the website to apply. They ensure your application is approved and you quickly get the money you need.

However, for this to be possible, you must follow all the instructions and fill in the correct details while applying.

So what are the advantages and disadvantages of choosing quick cash loans?

Pros of Choosing Quick Cash Loans

Application is easy

The internet has made life relatively easy for people, making it possible to stay anywhere and access the information you need. You can do this when you have an internet connection and a device to log in.

To gain access to the loan you need, you must access the application or website needed to get started on the application. You don’t need to stress yourself by physically going to the location of the loan agency to apply.

The requirements are easy.

Unlike most loans, this loan has easy requirements for an applicant to meet. You don’t need anything extra, just the basic things like your identity, proof that you are up to 18 years, sometimes a source of income, etc.

These requirements are pretty straightforward for people to meet. But, you must ensure that every piece of information you fill in is accurate to get approval.

No credit check

Unlike most loan application processes, when you apply for instant cash loans, you can be sure of getting approval because no credit check is required.

There are times that a credit check will be carried out. But, having a poor rating does not influence their decision to give you the loan. The lenders are concerned about how you will repay them.

This is why this loan option is great for many people, especially those with poor ratings. But, this can prompt people to apply for more money than they need. It can also make people neglect to have a good rating on their credit score because they are sure they will get a loan regardless.

Cons of Choosing Quick Cash Loans

Though instant loans have many advantages for their borrowers, it doesn’t stop the fact that it has disadvantages that have made people dislike this loan option.

Some of the reasons why people dislike this option are:

High-interest rate

Nearly everyone complains about the most pronounced drawback of this loan is its high-interest rate. When this loan is compared to other loans, there is a glaring difference in their interests.

Unfortunately, even with this being obvious, people still go for it when they need access to quick money because they are always never turned down.

People have attributed this high-interest rate to the fact that credit checks are not done, so the lender is taking a risk with their money by lending to someone with a bad credit rating.

A borrower can quickly be put in a debt cycle when it is time to repay the loan because they may not have enough money to offset the loan; hence, they need to borrow to clear it, and the cycle continues.

Additionally, the penalty for missing the payment plan is most times huge. So, when this is added to the interest, a borrower discovers that they will pay more than they imagined.

Short-term repayments plan

With instant cash comes limited time to repay the loan, which can make borrowers more difficult than they bargained for. Each lender has an expected time of repayment, but it is usually not more than twelve months.

A borrower should learn how to negotiate terms to the best for them. Contacting a loan agency like Payday Loans UK is also a good option because they will only send you lenders matching your needs.

To avoid defaulting on the repayment plan and incurring more debts in terms of interest, it is best that a borrower plan ahead on how they will repay the loan.

What needs to be cut down in terms of spending? How should you save up? Answering these questions and implementing them will make it easier to offset the debt.

Final thoughts

Taking out an instant cash loan though it could be beneficial based on your need at that point, could quickly become deficient in the long run.

Before finally settling on this loan option, you must carefully do your research and know if it is what you want. Then, you can reach out to Payday Loans UK to get the best option available.

Also know about bflix