Contents

A bounce after a decline is deemed a counter trend rally that will hit resistance below the beginning of the decline. Lawrence Pines is a Princeton University graduate with more than 25 years of experience as an equity and foreign exchange options trader for multinational banks and proprietary trading groups. Mr. Pines has traded on the NYSE, CBOE and Pacific Stock Exchange. In 2011, Mr. Pines started his own consulting firm through which he advises law firms and investment professionals on issues related to trading, and derivatives. Lawrence has served as an expert witness in a number of high profile trials in US Federal and international courts. The S&P 500 then used the 38.2% arc as support, bouncing between the 50% arc and the 38.2% arc for many months.

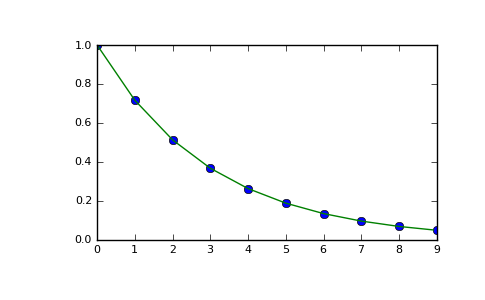

The sequence is run for 14 squares and a different color is used for each square. A complete rotation happens in 4 steps so the rotation variable is reset to 0 after the square sprite is placed in rotation step 4. Because of how each number in the sequence is the sum of the previous two, the Fibonacci numbers are sometimes used to represent natural growth rates. The second bullish impulse brings the price to the 161.8% Fibonacci extension arc and creates a little bearish bounce.

By plotting the Fibonacci retracement levels, the trader can identify these retracement levels, and therefore position himself for an opportunity to enter the trade. However please note like any indicator, use the Fibonacci retracement as a confirmation tool. Fibonacci retracement levels are widely used in technical analysis for financial market trading. The other argument against Fibonacci retracement levels is that there are so many of them that the price is likely to reverse near one of them quite often. The problem is that traders struggle to know which one will be useful at any particular time. When it doesn’t work out, it can always be claimed that the trader should have been looking at another Fibonacci retracement level instead.

How to Calculate Fibonacci Retracement Levels

Comparing the above chart to the Fibonacci arc, you can see how different the two approaches are. This is how regular Fibonacci tools such as the Fibonacci retracement or the Fibonacci extension tools are used. Because each swing measure has a full arc in itself, using two or three such arcs can make price analysis very confusing. A common way to use Fibonacci methods is to use them as a cluster. This mean, plotting the Fibonacci retracement levels across different swing points.

Modern artists and architects are fascinated by the Fibonacci sequence, but “this is as nothing” compared to the “obsession with the Golden Ratio” in past centuries. Fibonacci extensions are a method of technical analysis commonly used to aid in placing profit targets. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Due to the fact that they are widely used, the price levels as seen by the Fibonacci levels become areas of interest for traders. When you trade arc breakouts, you should enter the market in the direction of the arc breakout. In this case, you should place a stop beyond a crucial peak created in the time of the breakout. After the price finishes the bearish impulsive move, it starts a consolidation, which begins to produce higher highs.

Chartists sometimes need to add extra time to see future support or resistance levels on the chart. Chart 7 shows the S&P 500 ETF from mid March to mid July with 60 extra bars added. With these additional bars, chartists can see how the https://1investing.in/ arcs evolve in the future. This can be done by going to “chart attributes” and entering the number of periods for the extension in the “extra bars” box. Chart 7 shows the S&P 500 ETF from mid-March to mid-July with 60 extra bars added.

Fibonacci Arc

Figure 2 shows some smaller wave leading up to the wave shown in Figure 1. In the Fibonacci sequence, each number is the sum of the previous two numbers. Fibonacci omitted the “0” and first “1” included today and began the sequence with 1, 2, 3, … He carried the calculation up to the thirteenth place, the value 233, though another manuscript carries it to the next place, the value 377. Fibonacci did not speak about the golden ratio as the limit of the ratio of consecutive numbers in this sequence.

The chart above is of a bullish trend that enters a reversal phase. Now that you are familiar with Fibonacci arcs, we will now dig further into how to trade with the indicator. Simply choose if you are a beginner or an advanced trader and fill the form below.

The reason behind this is because there can be a lot of subjectivity involved. While it is easy to explain price action in hindsight, it can be quite a task to trade in real time especially based on where price could bounce. This explains the reason why that the Fibonacci arc drawing tool is not one of the default tools that are shipped with a trading or a charting platform that are widely used.

Therefore, your starting point will be the swing high and you will plot the Fibonacci arc to the swing low. So, what are Fibonacci arcs and how can they be used in trading? In this article, we explain what are Fibonacci arcs and how to plot them. It is not recommended that you use the Fibonacci arcs to trade blindly. Some amount of practice and familiarity is required in order to trade successfully with the Fibonacci arcs.

Attila Pethő proved in 2001 that there is only a finite number of perfect power Fibonacci numbers. Siksek proved that 8 and 144 are the only such non-trivial perfect powers. In this formula, one gets again the formulas of the end of above section Matrix form.

What Are Fibonacci Retracement Levels?

Price indeed initially bounces off these arcs but sooner than later, price reverses direction and continues to fall. An important point to mention is that when there is an upswing, the Fibonacci arcs present levels of potential support. Likewise, when there is a downswing, the Fibonacci arcs present potential areas of resistance.

This is known as Zeckendorf’s theorem, and a sum of Fibonacci numbers that satisfies these conditions is called a Zeckendorf representation. The Zeckendorf representation of a number can be used to derive its Fibonacci coding. The Fibonacci numbers are also an example of a complete sequence. This means that every positive integer can be written as a sum of Fibonacci numbers, where any one number is used once at most. The Fibonacci numbers can be found in different ways among the set of binary strings, or equivalently, among the subsets of a given set. Generating the next number by adding 3 numbers , 4 numbers , or more.

- Fibonacci arcs are typically used to connect two significant price points, such as a swing high and a swing low.

- Fibonacci numbers appear in the ring lemma, used to prove connections between the circle packing theorem and conformal maps.

- Fibonacci arcs are created by drawing a base line between two points.

- The classic opinion is that beauty exists when integral parts are arranged into a coherent whole exhibiting proportion, harmony, symmetry, unity, and order.

- Cory is an expert on stock, forex and futures price action trading strategies.

Fibonacci levels also arise in other ways within technical analysis. For example, they are prevalent in Gartley patterns and Elliott Wave theory. After a significant price movement up or down, these forms of technical analysis find that reversals tend to occur close to certain Fibonacci levels. For Fibonacci fans, the time affects the slope of the corresponding support and resistance levels, and therefore both time and price are factors. In conclusion, the Fibonacci arcs are one of the few technical tools that are not very popular.

SWING TRADING ADVANTAGES AND WHY IT IS THE BEST OPTION FOR BUSY TRADERS

Because of these drawbacks Fibonacci Arcs are generally used as analysis tools, or confirmation tools, as opposed to actually providing trade triggers. The Arcs can be drawn on major waves, like in Figure 1, which contain a number of small waves within them, or the Arcs can be drawn on each smaller wave. Drawing the Arcs on each smaller wave, as shown in Figure 2, is more applicable to active traders who want in and out on each wave.

Stocks, Futures Extend Rally After ECB Rate Hike: Markets Wrap

The Fibonacci retracement tool plots percentage retracement lines based upon the mathematical relationship within the Fibonacci sequence. I’ve encircled two points on the chart, at Rs.380 where the stock started its fibonacci arc rally and at Rs.489, where the stock prices peaked. The Fibonacci sequence is one of the simplest and earliest known sequences defined by a recurrence relation, and specifically by a linear difference equation.