Successful trading is not just about entering the markets at the right time; it’s also about knowing when to exit a trade. Exit indicators are essential tools that help traders lock in profits and limit losses. However, with a plethora of exit indicators available, finding the best one for your trading strategy can be a daunting task. In this comprehensive guide, we will explore tips to assist traders in identifying the most suitable exit indicator to enhance their trading strategies.

- Understand Your Trading Strategy

The first step in finding the best exit indicator is to have a deep understanding of your trading strategy. Are you a day trader looking for short-term gains, a swing trader aiming for medium-term profits, or an investor with a long-term perspective? Your trading strategy will significantly influence your choice of exit indicator.

- Consider Market Conditions

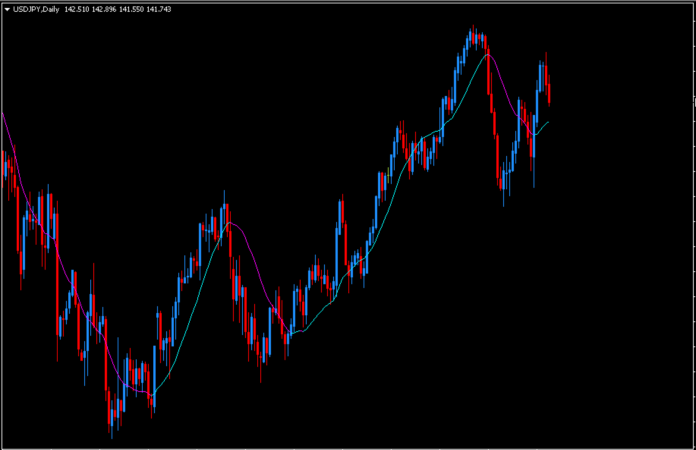

Market conditions can vary from trending to ranging or volatile. Your exit indicator should align with the prevailing market environment. For instance, moving averages may work well in trending markets, while oscillators like the Relative Strength Index (RSI) could be more suitable for ranging conditions.

- Combine Multiple Indicators

Enhance the robustness of your exit strategy by combining multiple indicators. Using a combination of technical indicators, such as moving averages, MACD, and Bollinger Bands, can provide a more comprehensive view of the market. Confirming exit signals from different indicators can reduce false signals and increase your trading accuracy.

- Backtest Your Indicator

Before implementing any exit indicator in live trading, it’s crucial to backtest it on historical data. Backtesting allows you to assess the indicator’s performance under various market conditions and timeframes. Evaluate the indicator’s effectiveness in generating accurate exit signals and its ability to align with your trading objectives.

- Align with Risk-Reward Ratios

A vital aspect of any exit strategy is managing risk. Ensure that your chosen exit indicator allows you to set stop-loss and take-profit levels that align with your risk tolerance and profit targets. The best exit indicator should enable you to implement sound risk management practices.

- Know Your Indicator’s Weaknesses

Every exit indicator has its limitations. Some may generate false signals in choppy markets, while others may lag behind price movements. Understand the weaknesses of your chosen indicator and be prepared to adapt your strategy when these limitations become evident.

- Stay Informed About Market Events

Fundamental factors can significantly impact market movements. Keep yourself informed about economic news, earnings reports, central bank decisions, and geopolitical events that could affect your trading positions. Combining fundamental analysis with your technical exit indicators can provide a more comprehensive view of the market.

- Exercise Patience and Discipline

Maintaining discipline is a challenge for many traders. Some exit signals may require patience as the market unfolds. Avoid impulsive decisions and stick to your predetermined exit strategy. A well-thought-out exit plan should help you avoid emotional reactions to market fluctuations.

- Monitor Market Sentiment

Market sentiment can be a powerful force in financial markets. Pay attention to sentiment indicators, news sentiment, and social media chatter related to your trading assets. Sudden shifts in market sentiment can influence your exit decisions.

- Continuously Adapt and Improve

The financial markets are dynamic, and what works as the best exit indicator today may not be as effective in the future. Stay open to exploring new exit indicators and refining your strategy as you gain experience and as market conditions evolve.

Conclusion

Finding the best exit indicator is a crucial aspect of trading success. It requires a thorough understanding of your trading strategy, the ability to adapt to changing market conditions, and a commitment to disciplined risk management. By combining multiple indicators, conducting rigorous backtesting, and staying informed about market developments, traders can improve their ability to make well-informed exit decisions.

Remember that no exit indicator is foolproof, and losses are an inherent part of trading. The key is to minimize losses while maximizing profits over the long term. With patience, discipline, and a continuous commitment to improvement, traders can identify the exit indicators that best suit their strategies and enhance their overall trading performance in the dynamic world of financial markets.